Disclaimer: This is an interpretation of the assessment records for account # 10082966. These records are for property tax assessment purposes only and have no legal bearing over any other jurisdiction.

Exhibit A – Appraisal Jacket 1965-1981

This represents the appraisal information of both land and improvements valuation from 1965 to 1981.

1971

The record shows that from at least 1971 the home was appraised as a stat class 141

1 – Single family residence

4 – Quality class 4; average

1 – One story

The year built of this home was estimated at 1948.

1978

The property was appraised in 1978 and the improvements (home) was updated to a stat class 151; meaning the judgement of the appraiser was that it was of quality above a class 4.

The estimated year built of the home was changed to 1945. There is no documentation stating why the year was changed.

Exhibit B – Drawing of improvements on property

Exhibit C – Deed card from 1952 to 1996

Exhibit D – 1977 appraisal

Exhibit B shows a home of 1567 ft², an attached garage with the dimensions of 18′ x 24′ and a detached carport with the dimensions of 12 x 23′. There is no date on this drawing. However, I interpret it to be prior to 1977 for two reasons:

1. The map and tax lot number at the upper right hand corner states 391E14C-4500. Exhibit C shows the map and tax lot were updated in the assessment records in 1981 to it’s current layout of 391E14CD-1700

2. Exhibit D shows an appraisal performed on 2/23/1977 which was signed by the owner of the property at the time as being a true representation of improvements at that time.

Exhibit D shows the home having converted the attached garage into livable ft² growing from 1597 ft² to 2010 ft². The appraisal also shows the appraiser judgement changing the carport to a 276 ft² class 4 attached garage. The appraiser also added a 640 ft² two story loft barn with low cost finish to the appraisal.

Exhibit E – 1980 appraisal

Home appraised as a stat class 5 at 2010 ft². Loft barn is on appraisal. However, 276 ft² detached garage has been removed from appraisal. Remarks on home are “outside looks like cl. 4 but inside is cl 5. home is well maintained.”

Exhibit F – 1983 Appraisal

Home continued to be appraised as 2010 ft² stat class 151. Loft barn @ 640 ft², comments on loft barn are “2 bedrooms upstairs N.V. (no value) yet.” In addition, land comments state “House placement; prohibits split in lot”

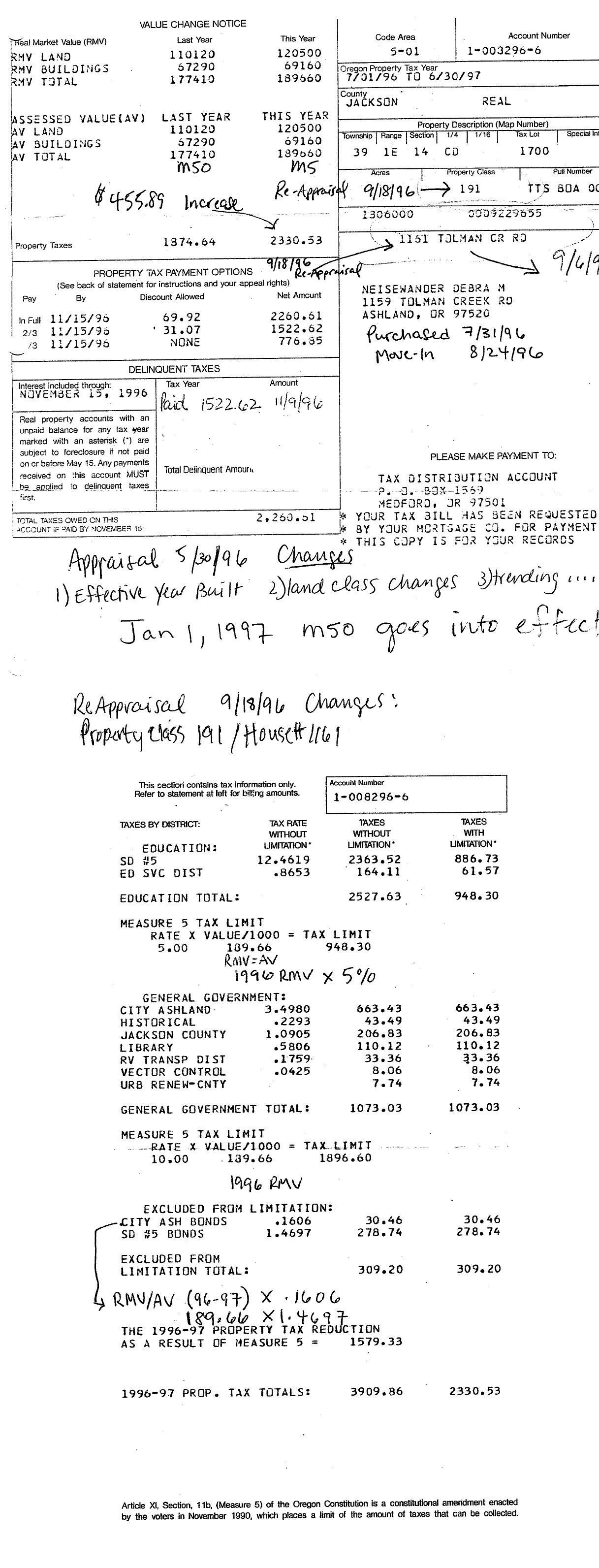

Exhibit G – 1989 + 5/30/1996 appraisal

There is no record of the 1989 appraisal showing appraiser actual changes. The only record that we have of the 1989 appraisal is the 5/30/1996 appraisal with the information placed on the account in 1989 being scratched out. The only difference between the 1989 and 1983 appraisal is that the appraiser at the time reduced the stat class of the home to a class 141.

The 5/30/96 appraisal further reduces the stat class of the home to a class 131 and updates the effective age of the home to 1955. The land is also appraised with the home site increasing in acreage from .30 of an acre to .35 of an acre. This was most likely due to a recalculation of the areas land values in which it was determined that .30 acres would sell for the same amount as a .35 acre lot would. There were also changes to eliminate a neighborhood adjustment (U52). The appraiser added a landscape (L15) 4 and added a location 2.

The property class of the property is a 101 meaning it is residential improved which can further be interpreted as not being able to be further developed. The situs address of this property is listed as 1159 Tolman Creek Rd.

These changes made during the site visit 5/30/96 were not entered into the appraisal valuation software system until 8/7/96.

Exhibit H – 5/30/96 updated on 8/14/96 and 9/24/96.

All components of the appraisal are the same as in Exhibit G. Excluding three main components:

- Property class changed to 191; meaning improved residential with the potential to be developed.

- The situs address changed to 1161 Tolman Creek Rd.

- A .26 acre building site replaces the previous rural tract land fragment on the appraisal.

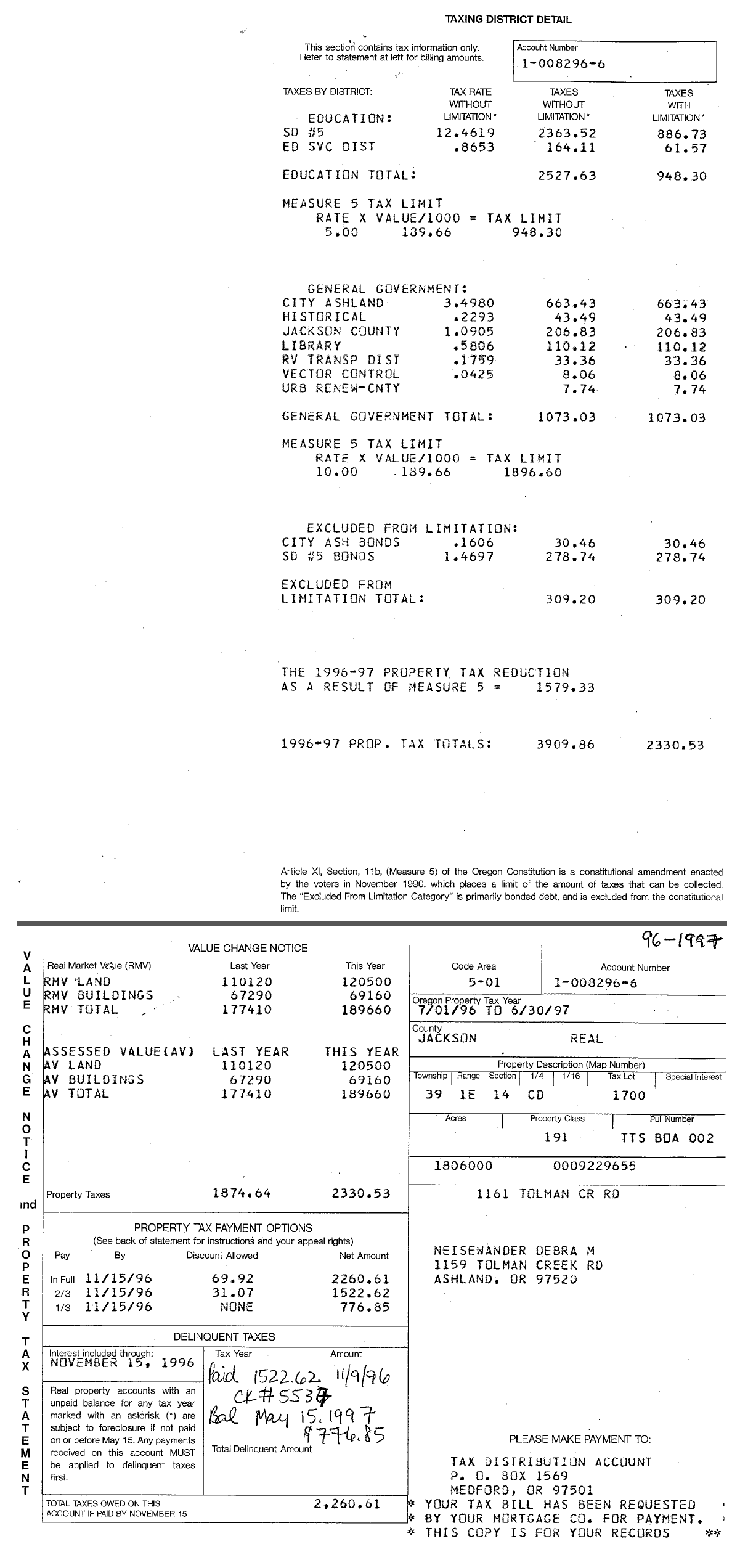

Measure 50

Measure 50 was voted into the Oregon Constitution. Prior to Measure 50, all properties were assessed on the Real Market Value (RMV). Although potentially limited by Measure 5 if that calculation exceeded a certain amount for schools or governments. Measure 50 established an additional value to a property called the Maximum Assessed Value (MAV). This figure was derived from the 1995 certified RMV minus 10%.

For account # 10082966, the RMV in 1995 was $177,410 which resulted in 1997 MAV being set at $159,670. Regardless of what appraisal judgement occurred in 1996, due to the timing of measure 50, the tax consequences were established correctly and not negatively affected by the 1996 appraisal judgments. The MAV grew by the constitutional 3% as prescribed by law until 2006.

Exhibit I – 2o06 Appraisal

Major changes occurred to the appraisal in 2006:

- The situs was changed from 1161 Tolman Cr. Rd to 1159 + 1169 Tolman Cr. Rd.

- The building site was changed to a homesite.

- The loft barn was changed to a 2nd dwelling. Year built was estimated at 1977 with an effective age of 1995 and a remodel year of 2005. Comments are “Changed loft barn to 2 of 2. Studio Apt on 2nd floor.”

Exhibit J – 2008 Appraisal

The 2008 appraisal has a comment from 6/13/07 with the comments “OSD conversion – table land.” There is no paper documentation of this change. The difference that I can interpret from the 2006 appraisal to the 6/13/07 change is that an onsite “market” development was added to the 2nd homesite. No changes were made during the 2008 appraisal.

Exhibit K (attachment missing) – Tax roll corrections (TRC)

A TRC was performed in 2009 based on the appraisal in 2006 for the 2nd homesite. Owner contacted office on 11/19/09 stating serious concern. TRC was not overturned. The TRC went back to the 2006 tax year and increased the MAV from $202,210 in 2005 to $284,090 in 2006 an increase in over 140%

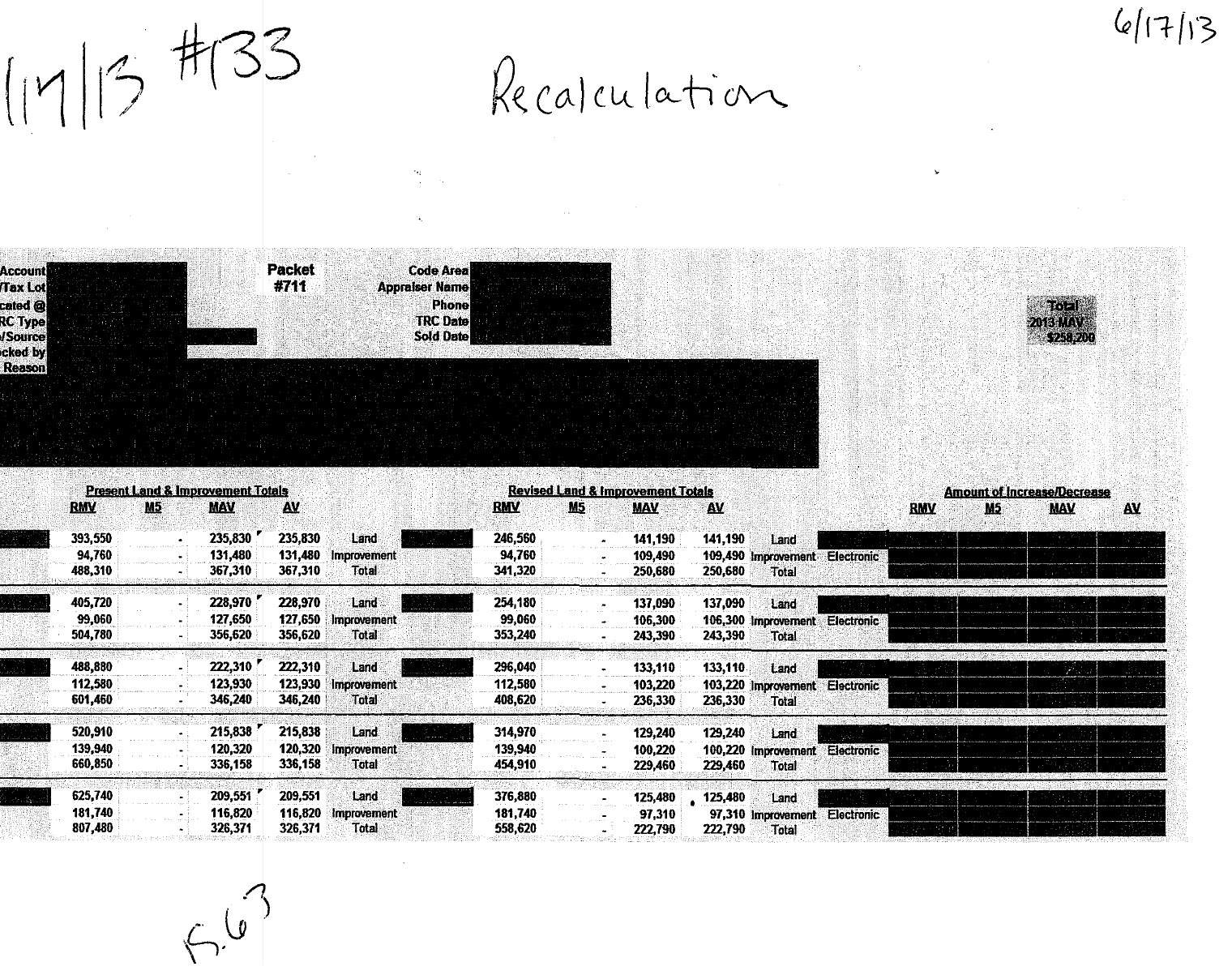

2013 TRC

Around April/May of 2013, owner visited office stating her concern with what had occurred in the past. We looked into the situiation. The results are stated as follows.

“06/13/13 the taxable value of this parcel was calculated incorrectly. #133 TRC #711

Notes – many errors found within “correction”. RMV changes added as exception. Original TRC by CA=#23 was in no way a “clerical error” therefore making the “correction” invalid. Appears loft barn to 137 was IR-RMV only but was CPR’d in error. TRC to remove all invalid exception and adjust appraisal to reflect was H+BU is (legally permissible – can’t split therefore no 2nd HS warranted at this time). No paperwork / appraiser notes to prove that 2nd house was ever valid or the appraisers intent to add to tax roll. Appears that RT was converted to 2nd HS in 2002 / 03 ORCATS conversion – re-created all changes based on all collected field sheets, appraiser notes, ect – removed off error and corrections from all years as a result of the 2009 TRC by CA.

TRC results of fixing invalid TRC

This office can only correct the current tax year plus five years back, in this situation, 2013 was the current year and five years back included: 2012, 2011, 2010, 2009 and 2008. Unfortunately, this office nor any other does not have the authority [to correct] the 2006 and/or the 2007 tax years. This resulted in an artificially high assessed value for those two years.

Exhibit L – Current appraisal

This is a copy of the current appraisal set up for this property. A site visit will occur in the next two weeks to verify contents of the appraisal. One of the main components of the appraisal to address is the loft barn being classified as a 137.

This is my interpretation of the history of appraisals and actions taken on tax account # 10082966 with the records kept in the Jackson County Assessor’s Office.

[Signature]

Josh Oliver Gibson

May 28th, 2014