TRC Report From Jackson County Data Analyst

This document comes from Data Analyst – Sara C (#133) outlining Tax Roll Correction (TRC) and reasons.

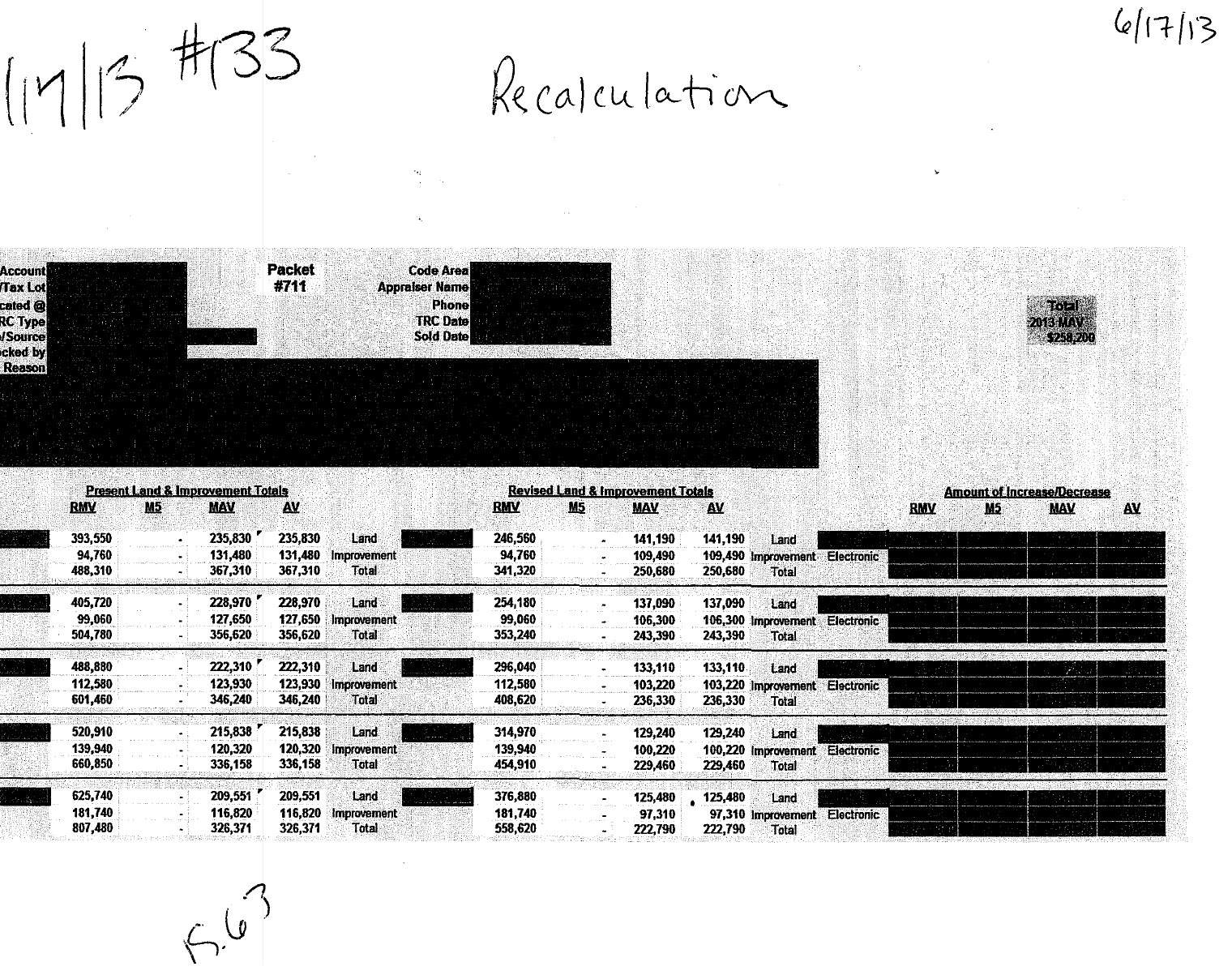

TRC Reason: The taxable value of this parcel was calculated incorrectly.

Many errors found within “correction”. RMV changes added as exception. Original TRC by CA#23 was in no way a “clerical error” therefore making the “correction” invalid. MM added in 07 & CPR’D in 08 in error. TRC to remove all invalid exception and adjust appraisal to reflect what H&BU is (legally permissible. Can’t split therefore no 2nd HS warranted at this time). No paperwork/appraiser notes to prove that 2nd HS was ever valid OR the appraisers intent to add to tax roll. Appears that RT was converted to 2nd HS in 2002/03 ORCATS conversion. Created all changes based on all collected field sheets, appraisal notes, etc. #133

also blocked are the years top 12-13 11-12 10-11 09-10 08-09

Read PDF version: TRC Report From Jackson County Data Analyst